Solid Tumor Testing Market - Share, Size & Global Industry Analysis 2024-2032

Introspective Market Research, a key leader in providing analytical market intelligence, today released its in-depth report on the Global Solid Tumor Testing Market . This critical market segment encompasses the entire suite of diagnostic products, technologies, and services used to identify, stage, and manage solid tumors—malignant neoplasms found in organs such as the lung, breast, prostate, and colon.

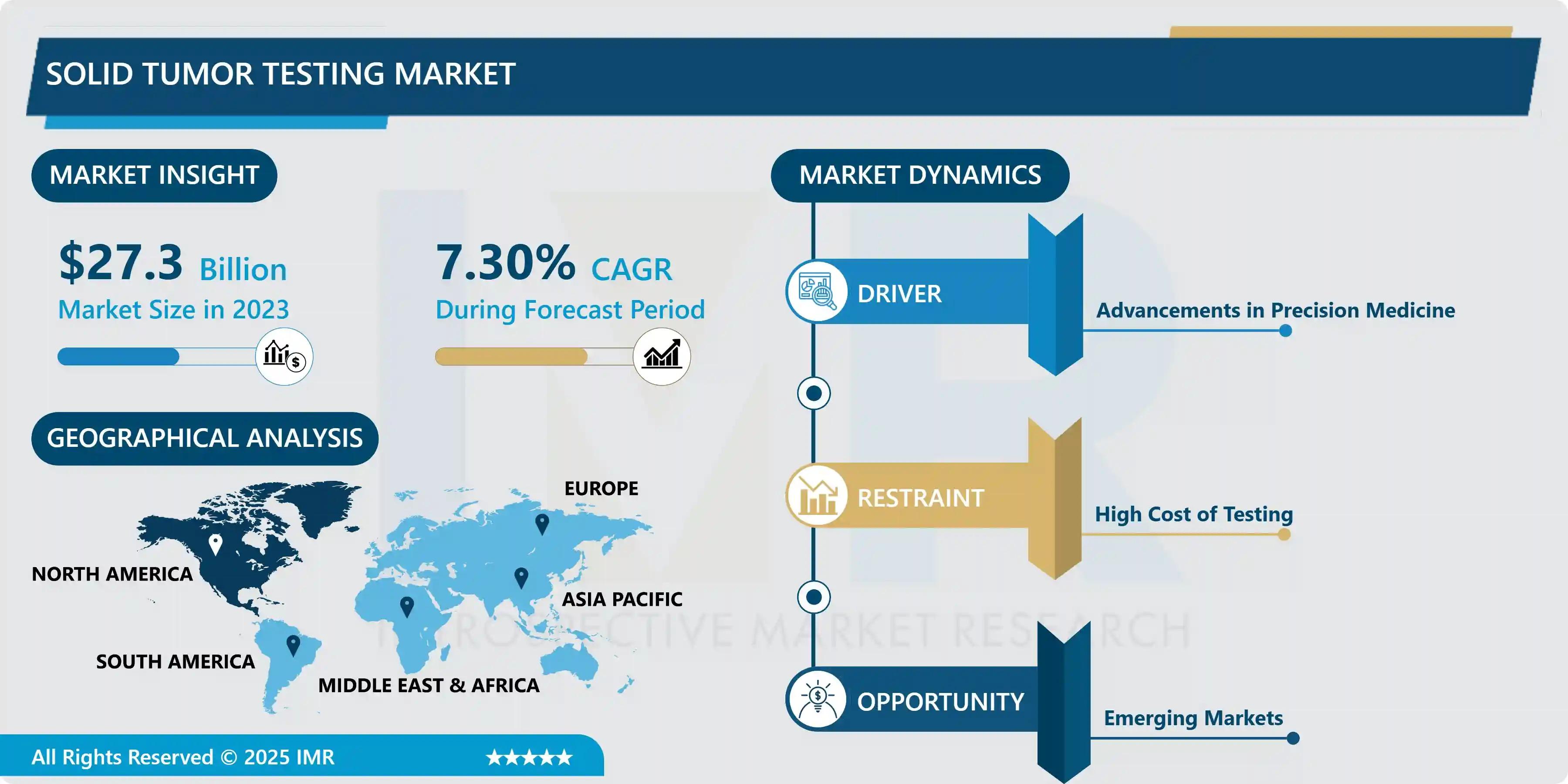

The Global Solid Tumor Testing Market size was valued at USD 27.3 Billion in 2024 and is projected to reach USD 51.4 Billion by 2032 , achieving a Compound Annual Growth Rate (CAGR) of 7.3% over the 2024–2032 forecast period. This significant expansion is primarily driven by the advances in precision medicine , which necessitates comprehensive molecular profiling of tumors to select the most effective, personalized therapeutic regimens.

Quick Insights: Global Solid Tumor Testing Market (2024–2032)

|

Metric |

Insight |

|

2024 Market Valuation |

USD 27.3 Billion |

|

Projected 2032 Valuation |

USD 51.4 Billion |

|

CAGR (2024-2032) |

7.3% |

|

Dominant Test Type |

Genetic Testing (Driven by NGS and molecular diagnostics) |

|

Leading Application |

Prostate Cancer (High incidence and screening frequency) |

|

Largest Regional Market |

North America (High R&D investment and advanced healthcare infrastructure) |

|

Key Market Drivers |

Advancements in Precision Medicine |

|

Key Opportunity |

Expansion into Emerging Markets (Asia-Pacific and Latin America) |

Segmentation Spotlight: Genetic Testing Dominates the Personalized Era

The segmentation analysis reflects the strategic shift from generalized diagnostics to molecular-level profiling:

- By Type: The Genetic Testing segment is poised to dominate the market throughout the forecast period. This includes Next-Generation Sequencing (NGS) and Polymerase Chain Reaction (PCR) techniques that identify specific genetic mutations and molecular changes (biomarkers) driving tumor growth. The increasing number of FDA-approved targeted therapies and companion diagnostics directly fuels demand for highly accurate genetic profiling.

- By Application: Prostate Cancer holds the largest market share in the application segment. This is attributed to the high prevalence of prostate cancer in the aging male population and the routine use of screening tools, including molecular assays and traditional PSA testing. The shift toward actively monitoring genetic markers in prostate cancer management ensures continued leadership for this segment.

How are NGS and Liquid Biopsies Reshaping the Diagnostic Landscape?

A major technological trend transforming the solid tumor testing market is the growing adoption of Next-Generation Sequencing (NGS) and the revolutionary Liquid Biopsy approach. NGS offers comprehensive genomic profiling (CGP), allowing clinicians to simultaneously analyze hundreds of cancer-related genes from a single tumor sample, improving the selection of targeted therapies and identifying resistance mechanisms.

The liquid biopsy trend is particularly disruptive. This non-invasive blood test detects circulating tumor DNA (ctDNA) or circulating tumor cells (CTCs) shed from the primary tumor. Liquid biopsies are rapidly gaining traction for:

- Early Detection in high-risk patients.

- Recurrence Monitoring post-treatment.

- Real-Time Monitoring of therapeutic efficacy.

This less invasive method provides a viable alternative or supplement to traditional, painful tissue biopsies, particularly when a tumor site is inaccessible.

Expert Insight: Bridging the Gap Between Innovation and Accessibility

“The pace of innovation in solid tumor testing, particularly with NGS and liquid biopsies, is incredible, allowing oncologists to tailor treatment with unprecedented specificity,” says Dr. Alistair Finch, Principal Consultant at Precedence Research. “However, the crucial challenge is bridging the gap between this cutting-edge technology and universal patient access. The High Cost of Testing, coupled with inconsistencies in reimbursement policies, creates significant cost pressures and restricts access, especially in emerging markets. Companies must focus on developing cost-effective, high-throughput instruments and securing broad payer coverage to ensure these life-saving diagnostic tools benefit the entire cancer population.”

Regional Leadership and Strategic Corporate Investment

North America remains the dominant global region, holding approximately 40% of the market share in 2023. This strong position is supported by the rapid adoption of advanced diagnostic technologies, a high prevalence of cancer, significant public and private funding for oncology research, and the concentrated presence of key players like Illumina, Inc., Guardant Health, and Thermo Fisher Scientific.

The most significant growth opportunity lies in Emerging Markets across Asia-Pacific and Latin America. Increasing healthcare awareness, improving access to advanced medical facilities, and rising government investments in national cancer prevention and diagnostic programs are creating fertile ground for market expansion in these regions.

Corporate Breakthroughs: Guardant Health continues to push the envelope in the liquid biopsy space with new FDA approvals for their blood-based testing platforms, moving liquid biopsy further into the early-stage cancer screening realm. Meanwhile, Roche Diagnostics and Illumina are focused on strategic partnerships to integrate their sequencing platforms directly with pharmaceutical companion diagnostics, streamlining the path from diagnosis to targeted treatment selection.

Challenges: Cost Barriers and Reimbursement Complexity

The major restraints on the market are interconnected: the high capital cost of NGS instruments and the associated cost of running comprehensive genetic panels. These costs contribute to significant reimbursement challenges, often limiting the use of sophisticated testing to academic medical centers and affluent regions. Additionally, the complexity of data interpretation requires highly skilled bioinformatics specialists, further adding to the operational costs for hospitals and laboratories.

Case Study: Liquid Biopsy Integration in Lung Cancer Monitoring

A major oncology center in the US implemented liquid biopsy as the standard-of-care for monitoring patients with non-small cell lung cancer (NSCLC) receiving targeted oral therapy. Instead of relying solely on periodic, costly, and invasive CT scans and tissue biopsies, the center used liquid biopsy to detect early signs of acquired drug resistance (a new mutation appearing in the ctDNA) before clinical progression was evident. This proactive monitoring allowed oncologists to switch therapies earlier, improving patient progression-free survival rates and significantly reducing the overall need for invasive procedures .

Call to Action

Define the Future of Oncology: Download the Full Solid Tumor Testing Market Report

About Introspective Market Research

Introspective Market Research (IMR) is a trusted provider of comprehensive market intelligence, offering in-depth insights into global industry trends, competitive landscapes, and growth opportunities. Our reports empower businesses to make informed, strategic decisions that accelerate growth and maximize value across diverse sectors.

Contact: Introspective Market Research Phone: +91-74101-03736 Email: sales@introspectivemarketresearch.com

Website: https://introspectivemarketresearch.com/