Why Carbon Credit Verification Is Essential for Climate Action

Introduction

The Carbon Credit Validation Verification Certification Market is experiencing rapid growth as governments, corporations, and environmental organizations prioritize measurable and transparent climate action. This market revolves around the processes that assess, validate, and certify carbon reduction projects—ensuring that emissions reductions claimed in carbon credits are accurate, additional, and credible. These services are essential for both compliance carbon markets and voluntary carbon markets, covering projects such as afforestation, renewable energy, energy efficiency, waste management, and industrial decarbonization. As global climate commitments intensify and carbon trading becomes more integral to sustainability strategies, the demand for rigorous validation and verification services continues to increase.

Market Drivers

A major driver of this market is the rising adoption of carbon neutrality goals among governments and multinational corporations. Companies seeking to offset emissions rely on high-quality verified carbon credits, which require standardized validation and third-party audits. Regulatory frameworks such as the EU Emissions Trading System (ETS), CORSIA for aviation, and national carbon pricing schemes fuel demand for accredited certification bodies. The growth of voluntary carbon markets encourages organizations to invest in nature-based and technology-based climate solutions, requiring independent verification to build trust among buyers. Additionally, increasing scrutiny of greenwashing practices drives the need for transparent monitoring, reporting, and verification (MRV) mechanisms.

Market Challenges

The Carbon Credit Validation Verification Certification Market faces challenges related to inconsistencies in international standards. Different carbon registries and protocols use varying methodologies, creating complexity in project validation. High costs of third-party audits may limit participation for small project developers. Time-intensive verification processes can delay carbon credit issuance and affect market liquidity. Technical challenges arise in accurately measuring emissions reductions from advanced technologies such as carbon capture, bioenergy, and methane abatement. Data quality and monitoring difficulties, particularly in remote or forest-based projects, pose operational risks. Additionally, geopolitical uncertainties and regulatory changes may disrupt carbon market stability.

Market Opportunities

There are significant opportunities in developing digital MRV platforms using satellite imagery, drones, IoT sensors, and blockchain technology to automate verification processes. AI-driven carbon accounting tools can streamline data gathering and enhance accuracy. Companies can expand services into emerging sectors such as blue carbon, regenerative agriculture, hydrogen production, and carbon removal technologies. The growth of voluntary markets in Asia-Pacific, Africa, and Latin America presents strong opportunities due to expanding climate projects and international funding. Standardizing methodologies and creating unified certification frameworks across markets can open doors for global operations. Partnerships between technology firms, environmental consultancies, and certification bodies will further enhance verification capabilities.

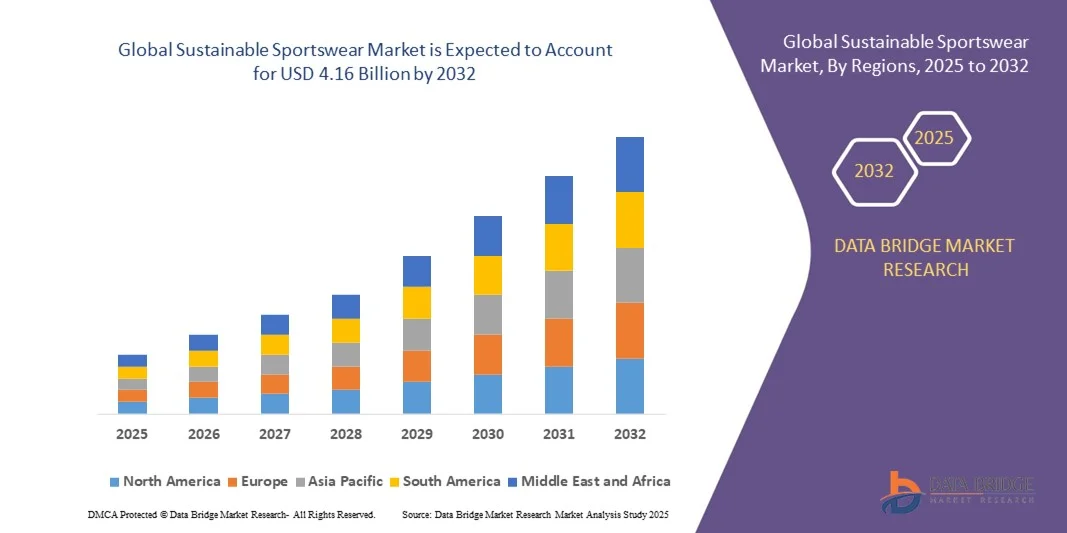

Regional Insights

Europe dominates the Carbon Credit Validation Verification Certification Market due to strong climate regulations, advanced carbon trading systems, and established certification bodies. North America follows, driven by corporate sustainability initiatives and expanding state-level carbon programs in the United States and Canada. Asia-Pacific is the fastest-growing region, supported by rapid climate project development in China, India, Indonesia, and Southeast Asia. Latin America shows strong potential with large-scale REDD+, reforestation, and renewable energy projects in Brazil, Peru, and Colombia. The Middle East demonstrates rising adoption of carbon strategies linked to hydrogen, renewable energy, and industrial decarbonization. Africa presents long-term opportunities as international financing supports large-scale forestry, land restoration, and clean energy projects.

Future Outlook

The future of the Carbon Credit Validation Verification Certification Market will be shaped by digital transformation, regulatory harmonization, and growth in nature-based and technological carbon removal solutions. Automated MRV systems using AI, satellite monitoring, and blockchain verification will significantly reduce costs and enhance transparency. Third-party certification will become mandatory for more sectors as governments expand climate regulations. High-integrity carbon credits linked to measurable and permanent reductions will gain value in both voluntary and compliance markets. As carbon removal technologies—such as DACCS, BECCS, biochar, and enhanced weathering—scale up, specialized verification methodologies will evolve. Long-term, strong demand for certified carbon credits will fuel expansion of global validation and verification services.

Conclusion

The Carbon Credit Validation Verification Certification Market continues to grow as global climate action intensifies and organizations prioritize credible carbon reduction strategies. Despite challenges involving high verification costs, inconsistent methodologies, and technical measurement complexities, strong demand is driven by the expansion of voluntary and compliance carbon markets. Advancements in digital MRV, satellite analytics, and blockchain technology will accelerate verification processes and improve trust. As nations and corporations move toward net-zero goals, reliable validation and certification services will remain essential for ensuring the integrity and impact of carbon credits.