Subsea Equipment Market Explained

Introduction

The subsea equipment market is a critical segment of the offshore oil and gas industry, supporting exploration, production, and processing activities beneath the ocean surface. Subsea equipment includes systems such as subsea trees, manifolds, control systems, umbilicals, risers, flowlines, connectors, and pumps that enable safe and efficient hydrocarbon extraction in deepwater and ultra deepwater environments. As offshore resources become increasingly important to meet global energy demand, subsea technologies play a vital role in accessing reserves located in challenging marine conditions. Subsea production systems reduce the need for surface platforms, lower environmental footprint, and improve operational flexibility. Continuous technological advancement has expanded the feasibility of subsea developments at greater depths and longer tiebacks. With offshore energy remaining a strategic supply source, the subsea equipment market continues to be a key enabler of offshore energy operations worldwide.

Market Drivers

One of the primary drivers of the subsea equipment market is the sustained demand for offshore oil and gas production. Many of the world’s remaining large hydrocarbon reserves are located offshore, driving investment in subsea infrastructure. Advancements in deepwater and ultra deepwater exploration technologies have made previously inaccessible fields economically viable. Cost optimization strategies favor subsea tiebacks to existing facilities, reducing capital expenditure compared to new platform installations. Growing focus on maximizing recovery from mature offshore fields also supports demand for subsea boosting and processing equipment. Improved reliability and standardization of subsea systems have increased operator confidence. Additionally, long term energy security concerns motivate investment in offshore developments, supporting steady demand for subsea equipment solutions.

Market Challenges

Despite strong strategic importance, the subsea equipment market faces several challenges. High capital and installation costs associated with subsea systems can limit project approvals during periods of low oil prices. Harsh offshore environments expose equipment to extreme pressure, temperature, and corrosion, increasing design and material requirements. Long project timelines and complex engineering processes raise execution risk. Maintenance and intervention activities are costly due to the need for specialized vessels and remotely operated vehicles. Supply chain disruptions and limited availability of skilled subsea engineers can impact delivery schedules. Environmental regulations and heightened scrutiny of offshore operations add compliance complexity. These challenges require continuous innovation, rigorous testing, and disciplined project management.

Market Opportunities

The subsea equipment market offers significant opportunities driven by technological innovation and evolving offshore strategies. Development of all electric subsea systems reduces complexity, improves efficiency, and lowers operating costs. Subsea processing and boosting technologies enable longer tiebacks and enhanced recovery, creating new demand segments. Digitalization and real time monitoring improve asset performance and predictive maintenance. Expansion of offshore gas developments and liquefied natural gas projects supports subsea infrastructure investment. Decommissioning and redevelopment of mature offshore fields also present opportunities for replacement and upgrade of subsea equipment. Emerging offshore regions and frontier basins offer long term growth potential as exploration activity expands. Collaboration between operators, equipment manufacturers, and service providers accelerates innovation and cost reduction.

Regional Insights

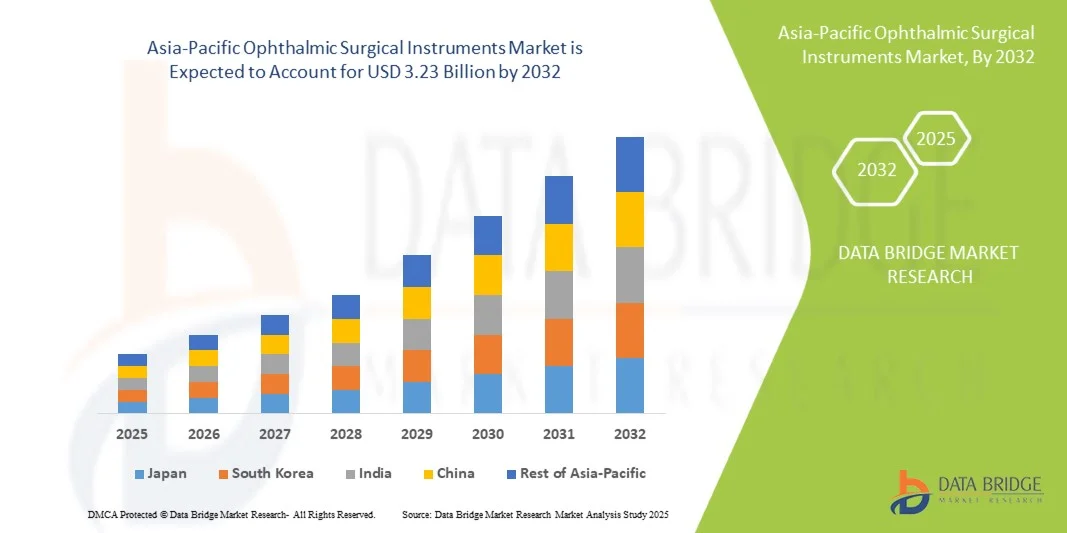

Europe represents a significant market for subsea equipment, driven by extensive offshore activity in mature basins and continued investment in technology innovation. The region emphasizes standardization and digital solutions to improve efficiency. The Middle East shows growing subsea activity as operators explore offshore developments and gas projects. Asia Pacific is an emerging market supported by offshore exploration and rising energy demand in coastal regions. North America remains a key market due to deepwater developments and technological leadership in subsea systems. Latin America, particularly regions with offshore resources, continues to attract investment in subsea infrastructure. Africa also offers growth potential through offshore developments, although investment depends on regulatory stability and financing conditions.

Future Outlook

The future of the subsea equipment market will be shaped by offshore energy demand, technological advancement, and cost discipline. Continued innovation will focus on reducing system complexity, improving reliability, and extending equipment lifespan. Digital integration and automation will enhance monitoring, diagnostics, and remote operation capabilities. Subsea processing is expected to gain wider adoption as operators seek to improve recovery and reduce surface facilities. While energy transition efforts may influence long term offshore investment, subsea systems will remain essential for producing offshore hydrocarbons efficiently. Strategic focus on gas developments and low carbon offshore solutions will also shape future market dynamics. Overall, subsea equipment is expected to remain a core element of offshore energy infrastructure.

Conclusion

The subsea equipment market is a vital enabler of offshore oil and gas production, supporting access to deepwater and complex reserves. Strong drivers such as offshore resource demand, technological progress, and cost optimization continue to sustain market activity. Although challenges related to cost, complexity, and environmental conditions persist, ongoing innovation and digitalization are addressing these issues. Opportunities in subsea processing, electrification, and emerging offshore regions enhance long term prospects. As offshore energy continues to contribute to global supply, subsea equipment will remain central to efficient, safe, and reliable offshore operations worldwide.