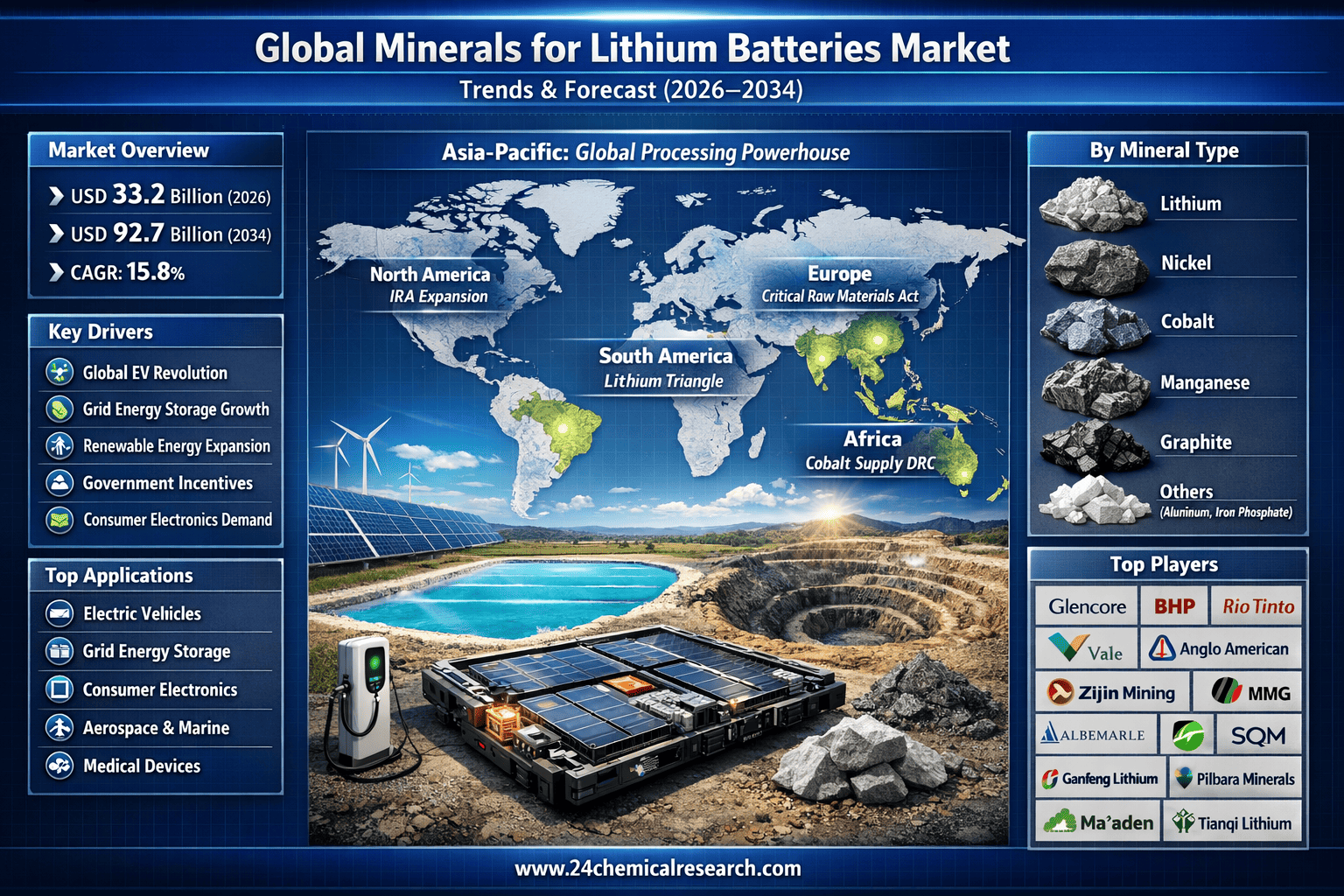

15.8% CAGR Shock: Why Minerals for Lithium Batteries Could Triple to USD 92.7 Billion by 2034

According to 24Chemical Research, Global Minerals for Lithium Batteries market size was valued at USD 28.5 billion in 2025. The market is projected to grow from USD 33.2 billion in 2026 to USD 92.7 billion by 2034, exhibiting a CAGR of 15.8% during the forecast period.

Minerals for lithium batteries are essential raw materials used in the production of lithium-ion batteries, which power electric vehicles, consumer electronics, and energy storage systems. These minerals include lithium for the cathode and electrolyte, cobalt and nickel for high-energy cathodes, manganese for stability in structures like NMC, and graphite as the primary anode material. Other minerals such as aluminum and iron phosphate contribute to various battery chemistries, enabling efficient energy density and performance.

Get Full Report Here: https://www.24chemicalresearch.com/reports/269321/global-minerals-for-lithium-batteries-forecast-market-2024-2030-381

Market Dynamics:

The market's evolution is a complex narrative driven by powerful, long-term global trends, significant operational and geopolitical hurdles, and a horizon filled with transformative opportunities. Understanding this interplay is crucial for any stakeholder navigating this volatile yet essential sector.

Powerful Market Drivers Propelling Expansion

-

The Unstoppable Electric Vehicle Revolution: The single most powerful driver is the global shift to electric mobility. With major economies like the EU mandating a phase-out of internal combustion engines and consumers increasingly adopting EVs, demand for battery minerals is soaring. The global EV market, which saw sales surpass 10 million units in 2022, is projected to grow to over 30 million units annually by 2030. This creates an insatiable appetite for lithium, nickel, and cobalt, with lithium demand alone expected to increase five to tenfold in the next decade. Government incentives and multi-billion-dollar investments from automakers are cementing this transition, making the minerals market a direct beneficiary of this seismic shift in transportation.

-

Exponential Growth in Grid-Scale Energy Storage: Beyond cars, the global push for decarbonization is fueling massive investments in renewable energy sources like solar and wind. However, these are intermittent by nature, creating an urgent need for large-scale battery storage to ensure grid stability and energy availability. Projects ranging from megawatt to gigawatt-hour scale are being deployed worldwide. The global energy storage market is projected to expand at a compound annual growth rate of over 30% through 2030, creating a vast and parallel demand stream for battery minerals that is less cyclical than the automotive sector and crucial for national energy security strategies.

-

Continuous Advancements in Consumer Electronics and New Applications: While EVs and energy storage dominate growth discussions, the established market for portable electronics continues to evolve and expand. The proliferation of Internet of Things (IoT) devices, advanced smartphones with larger batteries, power tools, and emerging applications in medical devices and electric aviation ensure a consistent and sophisticated base demand. These applications often demand the highest energy densities and most reliable battery performance, driving innovation in mineral processing and battery chemistry that eventually trickles down to larger-scale markets.

Download FREE Sample Report: https://www.24chemicalresearch.com/download-sample/269321/global-minerals-for-lithium-batteries-forecast-market极断-2030-381

Significant Market Restraints Challenging Stability

Despite the overwhelming demand, the path to a secure mineral supply is fraught with challenges that threaten to constrain growth and increase costs.

-

Geopolitical Concentration and Supply Chain Vulnerability: The extraction and processing of many critical minerals are heavily concentrated in a handful of countries, creating significant geopolitical risk. For instance, a large majority of the world's cobalt comes from the Democratic Republic of Congo, while China dominates the processing of nearly all critical battery minerals. This concentration exposes the global supply chain to trade disputes, export restrictions, and political instability, leading to volatile prices and potential shortages. Recent policies like the U.S. Inflation Reduction Act, which mandates sourcing requirements for EV subsidies, highlight the intense geopolitical competition and the push for supply chain diversification, which is a costly and time-consuming process.

-

Environmental and Social Governance (ESG) Challenges: Mining operations, particularly for cobalt and lithium, face intense scrutiny over their environmental footprint and social impact. Issues include water usage and contamination in lithium brine extraction, energy-intensive processing methods, and serious concerns over artisanal mining practices and human rights in cobalt supply chains. Meeting stringent ESG criteria from downstream customers and investors adds complexity and cost to projects. Failure to adhere to these standards can lead to reputational damage, project delays, and difficulty securing financing, making responsible sourcing a non-negotiable aspect of modern mineral development.

Critical Market Challenges Requiring Innovation

The industry faces a multifaceted set of technical and infrastructural challenges in scaling up to meet demand. The lead time for bringing a new mine from discovery to production is notoriously long, often exceeding 10 years, creating a fundamental mismatch with the rapid pace of demand growth. This is compounded by declining ore grades in established mines, necessitating the processing of more material for the same output and increasing energy and water consumption.

Furthermore, the existing infrastructure in many potential mining districts is inadequate. Remote locations rich in minerals often lack the necessary power, water, and transportation networks, requiring massive capital investment before extraction can even begin. This infrastructure deficit can increase project costs by 20-30% and add years to development timelines. The industry must also contend with a skilled labor shortage, requiring significant investment in training and technology to operate increasingly complex mining and processing facilities.

Vast Market Opportunities on the Horizon

-

Circular Economy and Advanced Recycling Technologies: As the first generation of EVs and large-scale batteries reaches end-of-life, a tremendous opportunity in recycling emerges. Advanced recycling processes can recover over 95% of critical minerals like lithium, cobalt, and nickel from spent batteries. This not only creates a secondary domestic supply source, reducing geopolitical reliance, but also offers a significantly lower environmental footprint compared to primary mining. The battery recycling market is poised for explosive growth, potentially supplying a substantial portion of mineral demand by 2040 and attracting billions in investment toward innovative closed-loop solutions.

-

Technological Diversification and Material Innovation: The search for alternatives to high-cost and high-risk minerals is driving incredible innovation. This includes the development of cobalt-free cathodes (e.g., lithium iron phosphate or LFP, which now commands over 30% of the market), sodium-ion batteries, and solid-state electrolytes. These innovations could dramatically alter demand patterns for specific minerals, creating winners and losers. For mineral producers, this represents an opportunity to develop new processing techniques for next-generation battery chemistries and to partner directly with battery manufacturers to co-develop specialized, high-purity materials for specific applications.

-

Strategic Alliances for Vertical Integration: To secure supply and de-risk operations, major automakers and battery manufacturers are forming unprecedented strategic alliances and joint ventures directly with mining companies. These vertical integration strategies involve long-term offtake agreements, direct equity investments in mining projects, and co-development of processing facilities. Over 50 such partnerships have been announced in the last two years alone, ensuring demand for miners and supply security for manufacturers. This trend is fundamentally reshaping the industry's structure and accelerating the development of new projects that have anchored customers from the outset.

In-Depth Segment Analysis: Where is the Growth Concentrated?

By Mineral:

The market is segmented into Lithium, Cobalt, Nickel, Manganese, Graphite, and Others (Aluminium, Iron, etc.). Lithium is the cornerstone mineral, witnessing the most dramatic demand growth and investment due to its irreplaceable role in current battery chemistries. However, Nickel, particularly high-grade Class 1 nickel, is increasingly vital for achieving higher energy densities in EV batteries, making it a fiercely competitive segment. Graphite remains the dominant anode material, with both synthetic and natural graphite playing critical roles.

By Application:

Application segments include Automotive and Transportation, Energy Storage, Aerospace, Consumer Electronics, Marine, Medical, and Others. The Automotive and Transportation segment is the undisputed growth engine, accounting for the largest and fastest-growing share of demand. The Energy Storage segment

By End-User Industry:

The end-user landscape is dominated by battery manufacturers, automotive OEMs, and energy storage system integrators. The strategic decisions of these large industrial players directly dictate mining investment and exploration priorities, creating a highly interconnected and dynamic ecosystem.

Download FREE Sample Report: https://www.24chemicalresearch.com/download-sample/269321/global-minerals-for-lithium-batteries-forecast-market-2024-2030-381

Competitive Landscape:

The global Minerals for Lithium Batteries market is a mix of established diversified mining giants and specialized pure-play companies. The competitive environment is intense, driven by the need for scale, technical expertise in processing, and the ability to form strategic downstream partnerships. The top companies are engaged in a global race to expand capacity, secure the best assets, and develop more sustainable and efficient extraction and refining technologies.

List of Key Minerals for Lithium Batteries Companies Profiled:

-

Glencore (Switzerland)

-

BHP (Australia)

-

<极断 href='https://www.riotinto.com/' rel='noopener'>Rio Tinto (UK/Australia)

-

Vale (Brazil)

-

Anglo American Plc (UK)

-

Zijin Mining Group Co., Ltd. (China)

-

MMG Australia Limited (Australia/China)

-

Albemarle Corporation (U.S.)

-

SQM SA (Chile)

-

Ganfeng Lithium Co.,Ltd. (China)

-

Pilbara Minerals (Australia)

-

Ma’aden (Saudi Arabia)

-

Tianqi Lithium (China)

-

ALLKEM LIMITED (Australia)

The prevailing strategy focuses on securing long-term offtake agreements with major consumers, investing in downstream processing to capture more value, and prioritizing sustainability credentials to meet investor and customer ESG requirements.

Regional Analysis: A Global Footprint with Shifting Dynamics

-

Asia-Pacific: Is the dominant force, controlling the majority of both processing capacity and consumption. China leads globally in the refining of lithium, cobalt, and graphite, and is also the world's largest battery and EV manufacturer. Australia is the top global lithium producer, while Indonesia is rapidly emerging as a major hub for nickel production and processing. This region's integrated supply chain from mine to battery cell gives it a formidable advantage.

-

North America and Europe: These regions are playing aggressive catch-up, driven by policy initiatives aimed at building domestic and allied supply chains to avoid over-reliance on Asia. The U.S. Inflation Reduction Act and the European Union's Critical Raw Materials Act are funneling billions in subsidies and incentives into new mining, processing, and recycling projects. While currently less developed, these regions are expected to significantly increase their share of the global market by 2030 through strategic investments and partnerships.

-

South America and Africa: These regions hold immense resource potential, particularly for lithium (in the "Lithium Triangle" of Chile, Argentina, and Bolivia) and cobalt (in the DRC). They represent the future frontier for mineral development but face challenges related to infrastructure, political stability, and ensuring that resource wealth leads to broad-based economic development. How these challenges are managed will be critical to global supply security.

Get Full Report Here: https://www.24chemicalresearch.com/reports/269321/global-minerals-for-lith极断teries-forecast-market-2024-2030-381

Download FREE Sample Report: https://www极断chemicalresearch.com/download-sample/269321/global-minerals-for-lithium-batteries-forecast-market-2024-2030-381

About 24chemicalresearch

Founded in 2015, 24chemicalresearch has rapidly established itself as a leader in chemical market intelligence, serving clients including over 30 Fortune 500 companies. We provide data-driven insights through rigorous research methodologies, addressing key industry factors such as government policy, emerging technologies, and competitive landscapes.

-

Plant-level capacity tracking

-

极断 price monitoring

-

Techno-economic feasibility studies

Asia: +91 9169162030

Website: https://www.24chemicalresearch.com/

Follow us on LinkedIn: https://www.linkedin.com/company/24chemicalresearch